It’s time to consider a more buyer-centric and data driven approach to understand deal health and increase momentum, via normalizing engagement and sentiment levels within buying committees.

Faced with economic uncertainty due to COVID, opportunity risk is higher than ever. Yet most sales leaders are accustomed to increasing coverage to manage pipeline risk. That strategy may not work.

Navid Zolfaghari, VP of Sales at Branch, uses stakeholder specific opportunity data, combined with deal stage analysis, to measure and manage high risk opportunities.

Listen to Navid describe how he uses this data, along with Sharad Verma, C0-Founder and CEO at Boostup.ai and Lisa Palmer, GTM Advisor & Partner, Global Business Outcomes at Teradata during the #ShiftHappens round table on Deal Health and Momentum replay here.

During this Shift, we considered some of the following questions:

How to measure sentiment, engagement, and risk, for multiple deals simultaneously?

Can we identify and measure specific risks that are indicative of overall deal health?

Can risk scores be used in combination with engagement scores to determine momentum?

The short answer is yes, the data is available, however data silos make access cumbersome.

Yet who has time to sort through the litany of emails, Zoom call transcripts, calendar meetings, and other communication channels to evaluate stakeholder sentiment across the buying commitee.

It’s much easier to compile data that supports our subjective bias, kind of like rooting for the home team, when the winning pitcher is on the mound, hoping for a strikeout to win the game.

The problem with subjective data analysis is there is more than one batter at the plate. In fact there are multiple players, or members in the buying committee, who themselves may be playing on different internal teams.

This is where the CRM pipeline model starts to fall apart, especially when oriented towards seller specific pipeline stages, and metrics limited to ACV, close date, and probability. This is not only incomplete, it can be misleading, and may lead to the losing the sale in the ninth inning.

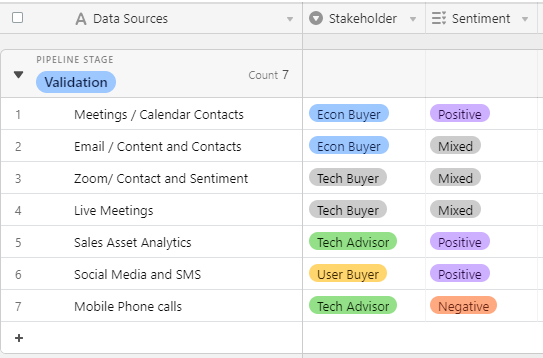

Consider the following scenario for the validation stage of a high risk opportunity:

This is the essence of a subjective deal review, with an overall gut instinct that feels “good” if that one pesky technical advisor could be “flipped” from negative to positive. The sentiment analysis is relatively straightforward, but the devil is in the details and the details are available.

For a variety of reasons, not shown explained in this very simple example, the AE may give this deal a high probability of closing, but the CRO may not, even though she may not explain why.

The CRO may simply discount the probability of the deal closing in her forecast, but not intrude on the AE’s passion to close the deal, in the absence of normalized opportunity data and a dynamic sales playbook.

With economic uncertainty the only constant in the near future, it’s vital to normalize opportunity data, provide a risk assurance matrix, and use a dynamic sales playbook to consider what-if scenarios when faced with a complex buying committee environment.